The Patient-Driven Groupings Model (PDGM) continues to dominate the conversation among in-home care providers, though some still see staffing as the industry’s top challenge.

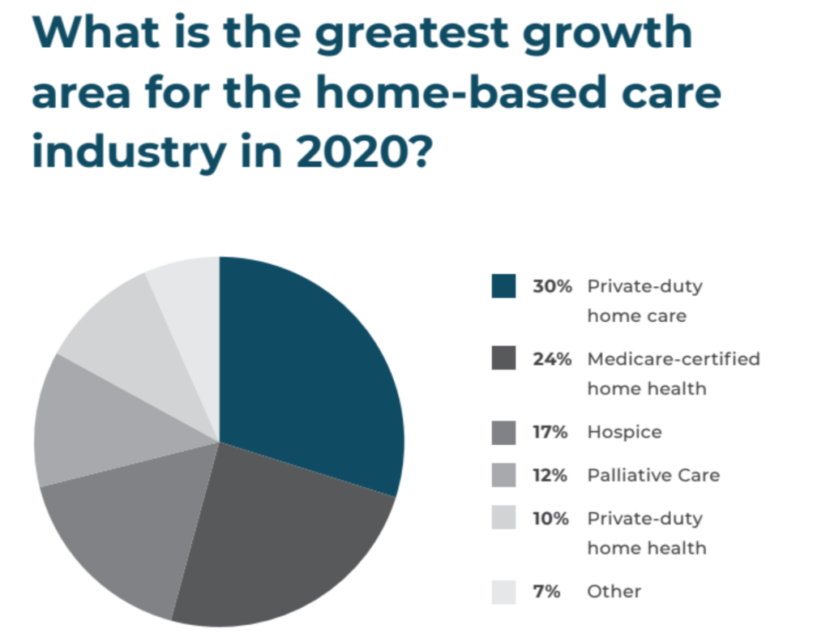

In terms of growth avenues, the majority of providers view private-duty home care as the best upcoming opportunity to scale their business in 2020. Even with PDGM, many remain bullish on home health care, too.

These are some of the key takeaways from the 2020 Home Health Care News Outlook Survey and Report, released Thursday, in collaboration with Homecare Homebase. The survey — conducted from December 2019 through January 2020 — reflects the opinions of more than 500 professionals working in or alongside the in-home care industry.

When it comes to challenges, 43% of survey respondents cited PDGM as their No. 1 pain point. PDGM only launched on Jan. 1, but it already has had a noticeable impact on therapy utilization and other aspects of the home health business model.

Going into 2020, many industry insiders predicted that PDGM would be the downfall of small and mid-size home health providers due to the disruption of cash flow and a complicated new documentation and coding processes.

Moving forward, PDGM will also likely impact M&A activity. Experts predict that M&A activity may slow down during the first quarter of 2020 while providers and other interested parties adjust to the new reimbursement landscape.

Overall, Q4 2019 saw five Medicare-certified home health-related transactions, compared to 16 home health-related deals in Q4 2018, according to recently released data from M&A advisory firm Mertz Taggart.

Despite the heavy spotlight on the new payment model, staffing — a pain point that impacts Medicare-certified home health agencies and non-medical home care agencies alike — still slightly beat out PDGM as the in-home care industry’s No. 1 challenge. In fact, 44% of survey respondents named staffing their top challenge.

Popular Reports

Advertisement

It should come as no surprise to those who have followed the matter closely, as the senior population is far outpacing the number of qualified and available caregivers. The demand for caregivers is expected to surge in coming years, creating 8.2 million job openings by 2028, according to PHI, a New York-based direct care workforce advocacy organization.

Further compounding staffing matters is the high turnover and low retention rates that have become the pervasive narrative within the in-home care space. Providers have had to become more creative in their recruitment and retention efforts.

BrightSpring Health Services, for example, implemented daily pay — through New York City-based DailyPay, a financial solutions company — in 2018.

“It is not uncommon for a home health care company using DailyPay to see 30% to 50% of its caregiver population enrolled in this benefit,” DailyPay CEO Jason Lee previously told HHCN. “These same companies have seen, on average, a 50% reduction of annualized turnover among the population of DailyPay users. The story is very clear: DailyPay is a benefit that caregivers are willing to stay for.”

Outside of industry challenges, 30% of survey respondents identified private-duty home care as a lucrative growth target for 2020, with 24% picking Medicare-certified home health as an opportunity for expansion. While robust, that interest pales compared to what providers see in hospice, as 71% of those surveyed identified end-of-life care as a key growth area in 2020.

Lafayette, Louisiana-based LHC Group Inc. (Nasdaq: LHCG) recently shared its intention to put hospice on equal footing with its home health business.

“For acquisitions going forward, home health is going to be natural for the next two to three years, but we are pushing our team to focus equally on hospice,” Keith Myers, chairman and CEO, said last month at J.P. Morgan’s annual health care conference in San Francisco. “The goal in the next five years is to have at least 75% of our locations where we have home health, co-located with hospice.”

Additionally, staffing utilization (39%), referrals (25%) and revenue cycle management (23%) were identified as the top three areas to achieve business efficiencies in 2020.