The IRR of a bond is the interest rate at which the cash flows it generates must be discounted so that the result of the current value is equal to the price of the bond.

In other words, in much simpler terms, the IRR is the real return that the bond generates. For example, if we buy a bond at 105 and they give us an annual coupon of 5%, we will actually have a return of less than 5%. Why? Because we have paid 105 and they will return 100 (they always return 100). Therefore, at that annual 5%, the value that they give us less should be discounted. On the contrary, if we buy a bond at 95 and they pay us 5% per year, in reality our IRR will be greater than 5%. We have paid 95 and they give us 100, that is, more than we have paid. Therefore, at 5% we will have to add that extra that will give us back more.

For this there are some formulas. Next we will see how the IRR is calculated and at the end we will see examples of the three possible cases. Buying a bond at par , buying a bond at a discount (below 100) or buying a bond with an issue premium (above 100).

Calculation of the IRR of a bond

The IRR formula was already seen in another article on the Internal Rate of Return . In this case, the formula is the same, but applied to investing in a bond. For simplicity, we can invest in two types of bonds:

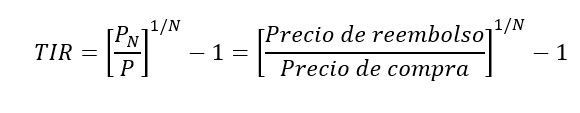

- Zero coupon bonds. The IRR of a zero coupon bond matches the spot interest rate. The only cash flow is the redemption price.

- Coupon bonds. The IRR of a coupon bond is obtained by trial and error through a formula. Currently, there are computer programs that facilitate this task.

Where P is the purchase price of the bond, Pn is the redemption price and C is the coupon for each period.

Example of calculation of the IRR of a bond

- Suppose a zero coupon bond, that is, a bond that does not distribute coupons. The purchase price of the bond is 109, the maturity is 3 years.

The IRR of this zero coupon bond is -0.028. If we multiply by 100 and express it as a percentage, it remains that the IRR of this bond is -2.8%. With which we can see that the yield of a bond can also be negative.

- Now suppose a coupon bond. The bond pays 5% per year, maturing in three years. And we will take into account three cases:

Discount purchased voucher (below 100)

The formula in the spreadsheet returns an IRR value of 6.9%. To verify that the calculation is correct, substituting this value in the formula above will fulfill equality.

Bonus bought at par (in 100)

After entering the values into the software, the IRR is exactly 5%. Thus, as long as the purchase value is equal to the redemption or redemption price, the IRR will be equal to the coupon.

After entering the values into the software, the IRR is exactly 5%. Thus, as long as the purchase value is equal to the redemption or redemption price, the IRR will be equal to the coupon.

Bond purchased with issue premium (above 100)

Finally, in bonds with an issue premium, the IRR will be less than the yield of the coupon. The spreadsheet extracts a IRR value of 3.22%.

Finally, in bonds with an issue premium, the IRR will be less than the yield of the coupon. The spreadsheet extracts a IRR value of 3.22%.

In the case of variable interest bonds , the formula to apply would be the same. However, the result would vary.

<!–

–>