Leasing is an atypical contract by which the company acquires the right to use an asset for a set period of time, against a series of recurring payments, called leasing fees.

Through leasing the company does not acquire ownership of the asset, but only the right to use it, in a similar and comparable way to rent. The asset, therefore, does not become part of the company assets. A subject (lessor or grantor) grants another (user) the right to use a specific asset against payment of the periodic rent. At the expiry of the contract, the user is usually given the possibility of purchasing the asset, exercising the purchase option, provided for in practically all leasing contracts, and paying the pre-established redemption price.

TYPES OF LEASING

Leasing can be operational or financial; this distinction depends on the content of the transaction and also on its formal elements. In detail, the two forms of leasing depend on both the type of contract and the number of subjects involved.

Operating lease

Operating leasing is a contract in which two parties intervene: Producer and User. The economic motivation of an operating leasing contract is exclusively linked to the enjoyment of an asset that is not really through the payment of a periodic fee, in fact a real rent. The final purchase of the asset is only a possibility, which can be foreseen or not foreseen in the contract itself. This type is configured as a lease agreement where there is no transfer of the risks associated with the use of the asset.

Financial leasing

Financial leasing, on the other hand, is a contract in which three parties are involved: Producer, Leasing company, User. A financial lease is stipulated when there is the need to finance an investment in capital goods, which would be too expensive to buy directly. The operation is a real purchase, with the transfer of the risks connected to the asset, the consideration for which is paid through periodic installments as an advance on the price of the asset.

THE ADVANTAGES OF LEASING

Why use leasing? The reasons that have made this type of contract successful over the years are many. The use of leasing allows:

- Acquisition of assets by deferring the relative payment over time

- It is easy, since it does not require particular forms of guarantee

- Facilitates the planning of financial aspects

- Advantage tax treatment (more in the past than now)

LEASING IN ACCOUNTING

We now come to the more technical part of the leasing contract, namely its management in our corporate accounting. There are two ways of accounting for this instrument: the equity method and the financial method: we will analyze both.

PLEASE NOTE: in light of the changes introduced for 2016 with Legislative Decree 139/2015, which introduced the principle of prevalence of economic substance over legal form in the financial statements, the equity method may no longer appear to be applicable as it “hides”, under the form of the lease, the substance of a deferred sale. Pending further clarifications, at the moment many still apply the equity method, so in this guide I will deal with it normally. I believe that it will remain an option applicable also for the financial statements from 2016 onwards, unless otherwise specified by the Revenue Agency, which at the moment have not been issued.

Equity Method

If you choose to account for the leasing contract using the equity method, the lease is treated as a normal lease, giving priority to the legal form over the economic substance of the contract.

The company records in the Costs of the Income Statement only the rents paid under the item “costs for the use of third party assets”. Only in the event of final redemption and after payment of the relative price, the asset will pass into the balance sheet of the lessee who will then amortize the redemption price paid and based on the residual possibility of using the asset.

In the Explanatory Notes to the Financial Statements, for reasons of correct information and transparency, the effects that would occur applying the financial method must be indicated. As for the memorandum accounts, the Legislative Decree 139/2015 art. 6 amended the civil code to art. 2424 repealing for the financial statements with effect from 01/01/2016 the rule that required to indicate in the memorandum accounts the financial commitments for guarantees given directly or indirectly, with the distinction between sureties, endorsements, other personal guarantees and real guarantees. Consequently, it is no longer considered necessary to record financial commitments for payment of the sum of the residual installments of the leasing contract in the memorandum accounts.

Financial Method

As indicated above, the novelty that inserts the prevalence of economic substance over legal form among the principles for preparing the financial statements certainly favors the use of this method of recording the leasing contract. In the financial method, leasing is treated as a sale in all respects. Let’s now see the accounting steps to be carried out:

- the asset is recorded under fixed assets at the time of delivery (as in the case of purchase)

- a payable equal to the amount financed is recognized

- at the time of payment of the periodic fees, both the interest expense implicit in this fee for competence and the reduction in the loan are recorded;

- at the end of the year, the asset is depreciated in the financial statements as for direct purchases of capital goods.

Basically, the asset is treated almost as if it had been purchased with a bank loan, excluding VAT.

PRACTICAL EXAMPLE

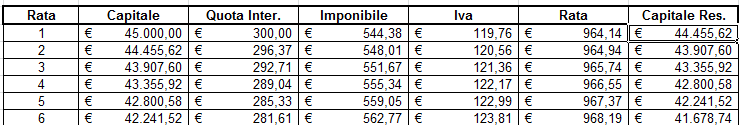

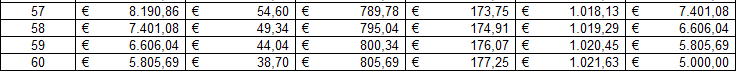

After the theoretical part, we see an example of how to manage a leasing with the two methods of recording operations. For example, suppose that a leasing contract is stipulated for an instrumental equipment or machinery for the company’s activity for a value of € 50,000.00 + 22% VAT for 5 years (60 monthly installments): we will pay a advance of € 5,000.00 + VAT 22% and there will always remain a residual of € 5,000.00 as redemption value. In the Excel file I am attaching the complete leasing plan; in the table below I report the first and last part of the fees by way of example.

Application of the Equity Method

In this case, the first registration to be made is that of the advance fee paid, in our example equal to € 5,000.00. Two entries must be made for each monthly fee: the first records the payable to the leasing company and the cost in the appropriate account in the Income Statement:

| BILL | GIVE | TO HAVE |

|---|---|---|

| 220.004 Leasing Company SpA | € 6,100.00 | |

| 315.40 MACHINERY LEASING FEES | 5,000.00 | |

| 230.10 VAT PURCHASES | € 1,100.00 |

The second registration settles the debt with the leasing company by withdrawing the money from the financial resource used, in our case the bank:

| BILL | GIVE | TO HAVE |

|---|---|---|

| 220.004 Leasing Company SpA | € 6,100.00 | |

| 250.20 SAVINGS CASH | € 6,100.00 |

Now let’s see the payment of a fee (let’s use the first of the proposed plan): here, in addition to the recording of the fee and VAT, the interest paid must also be recorded.

| BILL | GIVE | TO HAVE |

|---|---|---|

| 220.004 Leasing Company SpA | € 964.14 | |

| 315.40 MACHINERY LEASING FEES | € 544.38 | |

| 230.10 VAT PURCHASES | € 119.76 | |

| 350.70 LEASING INTERESTS | € 300.00 |

And here too we pay off the debt with the leasing company by withdrawing the money from the financial resource used:

| BILL | GIVE | TO HAVE |

|---|---|---|

| 220.004 Leasing Company SpA | € 964.14 | |

| 250.20 SAVINGS CASH | € 964.14 |

After you have paid the last installment of the plan, if you decide to redeem the asset that is the subject of the contract, you will have to pay the relative surrender value. In this case, the relative registration must be made to record the residual value of the asset in the fixed assets to be then depreciated. In our case, the redemption value is € 5,000.00. Here is the recording:

| BILL | GIVE | TO HAVE |

|---|---|---|

| 220.004 Leasing Company SpA | € 6,100.00 | |

| 110.40 MISCELLANEOUS EQUIPMENT | € 5,000.00 | |

| 230.10 VAT PURCHASES | € 1,100.00 |

Application of the Financial Method

In this case, the accounting is managed in a completely different way. First of all, the asset must be recognized for its entire value among fixed assets, as if it had been purchased directly. Here is the recording:

| BILL | GIVE | TO HAVE |

|---|---|---|

| 220.004 Leasing Company SpA | € 61,000.00 | |

| 110.40 MISCELLANEOUS EQUIPMENT | € 50,000.00 | |

| 230.10 VAT PURCHASES | € 11,000.00 |

At this point, the fixed asset will follow its periodic depreciation path based on the type of asset and the depreciation rates, while the payable to the leasing company will be gradually reduced on the basis of periodic rent payments. Now let’s see how to pay the fee in advance:

| BILL | GIVE | TO HAVE |

|---|---|---|

| 220.004 Leasing Company SpA | € 6,100.00 | |

| 250.20 SAVINGS CASH | € 6,100.00 |

The periodic installments that will be paid will have, as can be seen in the leasing plan, also an interest portion that at the time of purchase was not accounted for as it accrues as time passes. Consequently, at the expiry of each installment we must account for the interest to be paid as a credit of the leasing company. Here’s how to do it (let’s use the first canon of the proposed plan):

| BILL | GIVE | TO HAVE |

|---|---|---|

| 220.004 Leasing Company SpA | € 300.00 | |

| 350.70 LEASING INTERESTS | € 300.00 |

Now we can pass the payment of the first fee, including principal, interest and VAT, to the leasing company:

| BILL | GIVE | TO HAVE |

|---|---|---|

| 220.004 Leasing Company SpA | € 964.14 | |

| 250.20 SAVINGS CASH | € 964.14 |

The final redemption fee will be recorded in the same way as the prepaid rent: if all the registrations are correct, it will cancel the debt to the leasing company.

FINAL REMARKS

Leasing is certainly an infrequent topic in the company’s business but, as you have seen, it is rather complex and it is good to know it thoroughly, also to be able to evaluate it well in case you have to choose the best tool for the purchase of capital goods. In the last year it is undergoing a revision from the point of view of tax and accounting treatment, so it will always be good to check for any further clarifications and changes. It remains a tool to be evaluated and used well. In this article I have therefore made a fairly thorough discussion of it to put you in a position to understand it and know how to evaluate it well.