In 2019, Medicare Advantage (MA) plans were given clearance to offer extended health-related services and benefits to certain chronically ill enrollees starting in 2020. The move doubled down on a similar MA expansion announced in 2018.

While the 2019 and 2018 updates were separate, they both created potential MA opportunities for in-home care providers.

Providers already had a good idea of opportunities tied to the 2018 supplemental benefits expansion of “primarily health related” for months. Now, they also have an idea of what plans are currently doing under 2019’s SSBCI option — “Special Supplemental Benefits for the Chronically Ill.”

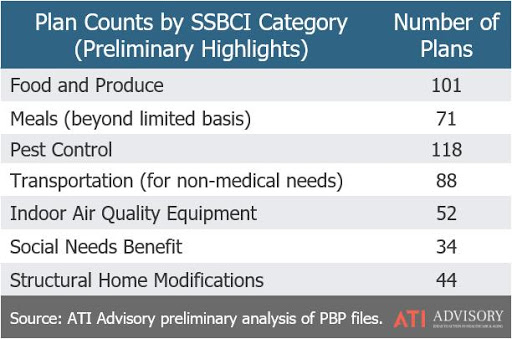

The first set of SSBCI data was released earlier this week. Thus far, there are at least 245 plans offering at least one of the SSBCI options, according to the Washington, D.C.-based research and advisory services firm ATI Advisory, formerly known as Anne Tumlinson Innovations.

“This is such a big change,” Anne Tumlinson, founder and CEO of ATI Advisory, told Home Health Care News. “There’s a lot of risk for health plans when stepping out on this ledge. And so the fact that even some of them are doing it is very encouraging and I’m optimistic that it will grow over time. This is just the first year.”

The U.S. Centers for Medicare & Medicaid Services allowed plans to select preferences from 10 SSBCI benefits or provide their own benefit ideas back in 2019.

The majority of the highest-utilized benefits included in the 245 existing plans are ones that home care providers could — or already do — offer.

For example, providing food and produce support is included in 101 plans. Transportation services are included in 88 plans, while meals — extended beyond a temporary basis — are included in 71.

Popular Reports

Advertisement

The most common benefit under SSBCI is pest control, included in 118 plans.

“In-home services and support, which is a part of the primary health pathway, I think we’re optimistic that’s going to continue to grow,” Tumlinson said. “As for the SSBCIs, I think that the transportation and the meals are things that home care agencies often provide.”

Social determinants of health have been a buzz term in home-based care of late, and that’s what the SSBCIs aim to improve in patients. If MA plans are able to partner with more home care providers through SSBCI, it’ll likely allow them to take a more whole-person approach to care.

“There aren’t a lot of carriers offering these benefits yet, but the ones who are, they are really experimenting,” Tumlinsoin said. “In 2021, I think we’ll get more take up and more interest as more conservative carrier organizations look at the experience of these plans and see what’s possible, and perhaps decide to be more competitive in offering similar types of benefits.”

Among the other SSBCI offerings are complementary therapies, services supporting self-direction, structural home modifications and social needs benefits. Services supporting self-direction include legal help or technology education.

Home modification — installing grab bars or widening doorways — is also a service that many home-based care organizations offer.

“None of the [offerings] are a surprise,” Tumlinson said. “Those are the things that everyone has been talking about. Transportation and meals are also benefits that can be offered as primarily health related benefits in a slightly more constrained way. Meals and transportation are hands down the biggest categories right now.”

The most aggressive MA player working through SSBCI right now appears to be Anthem Inc. (NYSE: ANTM), the for-profit health insurance giant. Of the 245 plans, Anthem is responsible for close to 100, ATI said.

Other than Anthem, some regional insurers have been early adopters of MA plans, such as California-based Scan Health. Scan is contracted with the Los Angeles-based non-medical home care provider 24 Hour Home Care, which was one of the earliest providers to pounce on MA opportunities.

“There’s more regional players involved, which actually doesn’t surprise me at all,” Tumlinson said. “I think regional plans are more likely to do this then [the big national ones], and the reason is because they know the service providers at the local level. They’re well equipped to partner with a community-based organization, a social services organization or an adult day care center.”

While ATI Advisory doesn’t yet know exact specifics of the offerings, the benefits offered in plans are mostly as expected thus far.

“I think [the data] is really what we expected. CMS told us in the fall there were about 245 or 250 plans. We knew that number,” Tumlinson said. “Where we’re seeing the most concentration is what we expected, the carriers are who we expected. I don’t think we’re really surprised by anything except for the service dogs support.”

Yes, service dogs are one of the SSBCIs that are being included — 51 plans have offered the benefit so far.

At the end of last year, home-based care operators were generally disappointed with how little the increased MA flexibility was taken advantage of by plans.

The original data suggests that the SSBCIs may have a slower roll out as well, but providers should not count them out as a potentially useful revenue stream in the future.

“[Medicare Advantage] has not been a huge windfall, and we never thought it would be in 2020,” Jennifer Tucker, COO of Homewatch CareGivers, told HHCN earlier this month. “It’s still gaining momentum.”